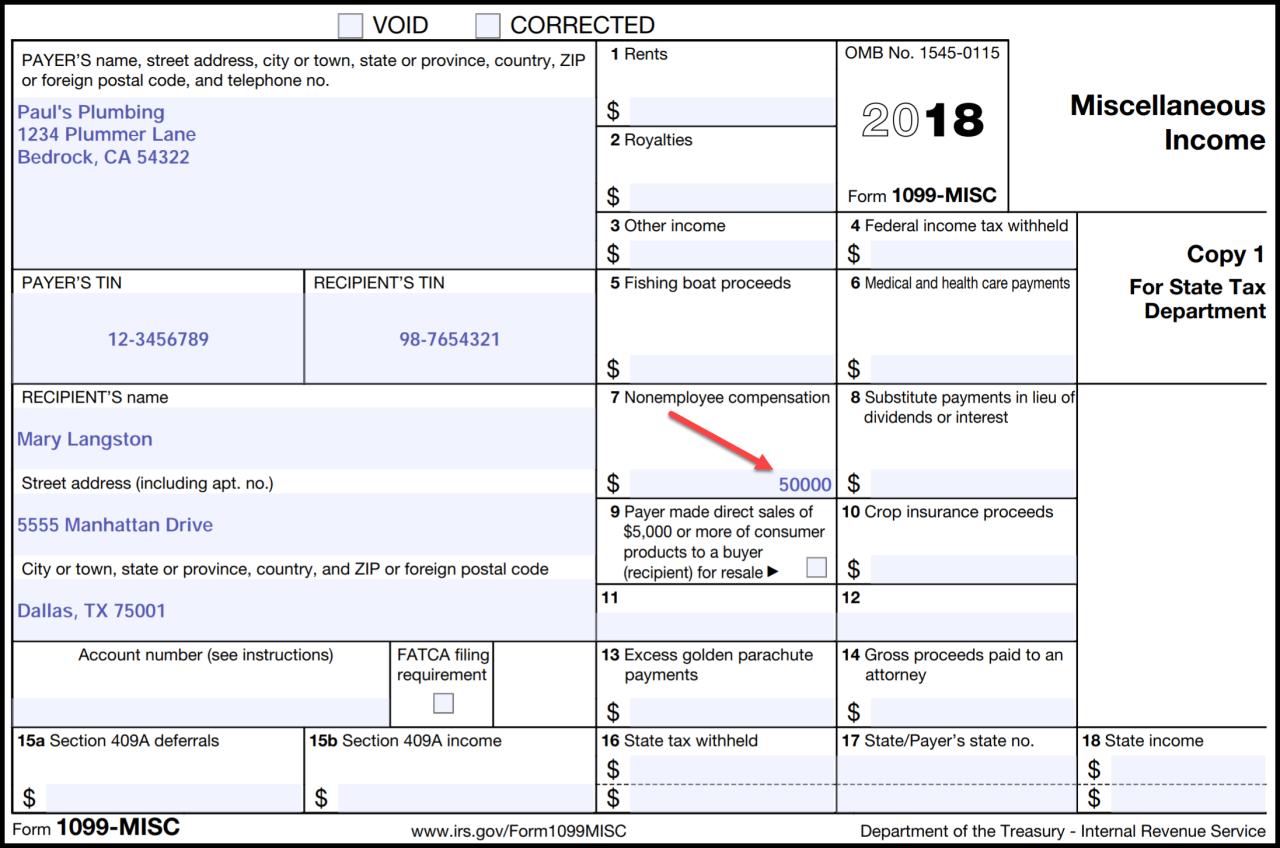

What is a 1099 Document?

A 1099 document is a tax form used to report income that is not subject to withholding. This includes income from self-employment, dividends, and interest. The form is used to report the amount of income received, as well as any taxes that have been withheld.

Who Needs to File a 1099 Form?

Any person or business that makes payments to another person or business that total $600 or more in a calendar year must file a 1099 form. This includes payments for:

- Self-employment income

- Dividends

- Interest

- Rents

- Royalties

- Prizes and awards

- Nonemployee compensation

What are the Different Types of 1099 Forms?

There are several different types of 1099 forms, each of which is used to report a different type of income. The most common types of 1099 forms include:

- Form 1099-NEC: This form is used to report nonemployee compensation. This includes payments made to independent contractors, freelancers, and other individuals who are not considered employees.

- Form 1099-INT: This form is used to report interest income. This includes interest earned on savings accounts, certificates of deposit, and bonds.

- Form 1099-DIV: This form is used to report dividend income. This includes dividends paid on stocks and mutual funds.

- Form 1099-R: This form is used to report retirement income. This includes distributions from IRAs, 401(k) plans, and pensions.

- Form 1099-G: This form is used to report government payments. This includes unemployment benefits, Social Security benefits, and tax refunds.

How to File a 1099 Form

1099 forms can be filed electronically or by mail. The deadline for filing 1099 forms is January 31st of the year following the year in which the income was received.

Penalties for Failing to File a 1099 Form

Failure to file a 1099 form can result in penalties. The penalty for failing to file a 1099 form on time is $250 per form. The penalty for failing to file a 1099 form at all is $500 per form.

Conclusion

1099 forms are used to report income that is not subject to withholding. These forms must be filed by any person or business that makes payments to another person or business that total $600 or more in a calendar year. There are several different types of 1099 forms, each of which is used to report a different type of income. The deadline for filing 1099 forms is January 31st of the year following the year in which the income was received. Failure to file a 1099 form can result in penalties.