Understanding the Purpose and Significance of Form K-1

Form K-1 is an intricate tax document issued annually by partnerships, S corporations, limited liability companies (LLCs), and other pass-through entities to their individual partners or shareholders. It serves as a crucial tool for reporting each partner’s or shareholder’s share of income, deductions, credits, and other tax-related information. Understanding this document is essential for accurately preparing and filing individual tax returns.

Who Receives Form K-1?

- Partnerships: Each partner receives a Schedule K-1 from the partnership.

- S Corporations: Shareholders of an S corporation receive a Schedule K-1.

- Limited Liability Companies (LLCs): If an LLC elects to be taxed as a partnership, its members receive Schedule K-1s.

- Trusts and Estates: Beneficiaries of trusts and estates may receive Schedule K-1s.

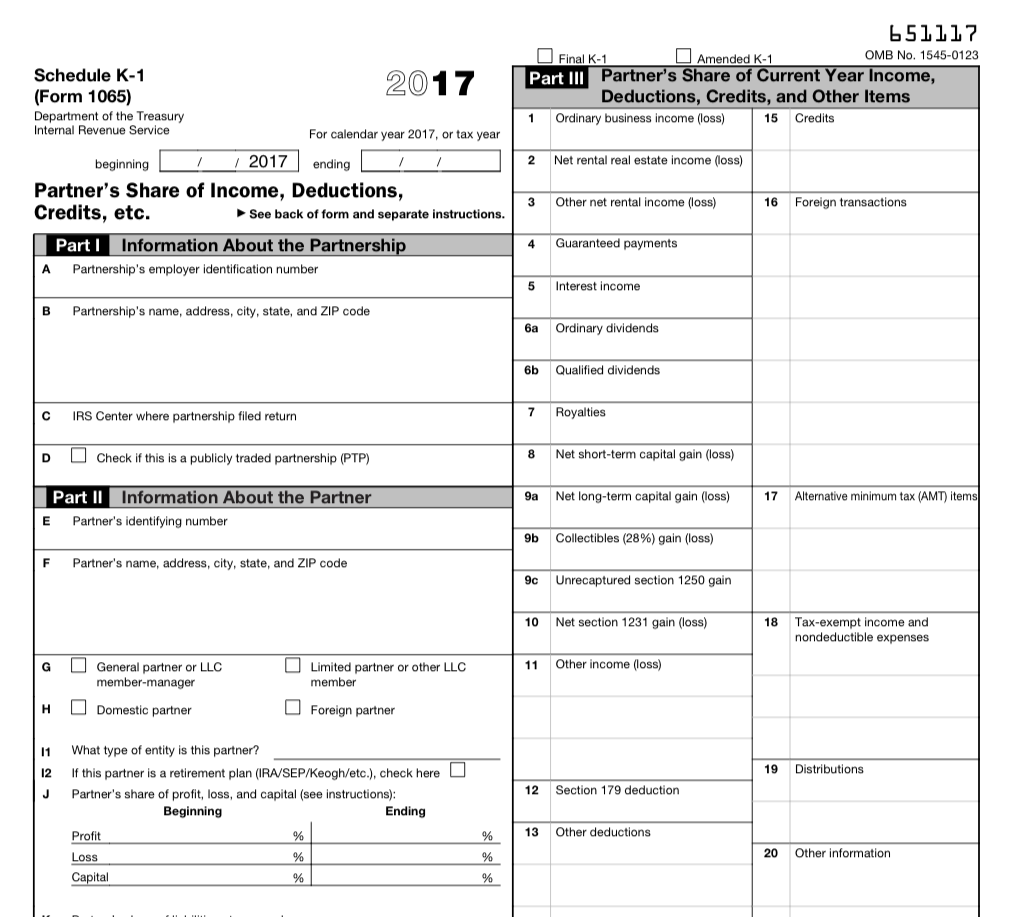

Deciphering the Sections of Form K-1

Form K-1 consists of multiple sections, each containing specific information. Here’s a breakdown of the key sections:

Section I: Partner’s Share of Income, Deductions, Credits, etc.

- Line 1: Ordinary Income: Reports the partner’s share of ordinary income or loss.

- Line 2: Net Income or Loss: Reflects the partner’s net income or loss from the partnership.

- Line 3: Capital Gain or Loss: Shows the partner’s share of capital gains or losses.

- Line 4: Other Income or Loss: Includes other income or loss items not specified elsewhere.

Section II: Partner’s Distributive Share of Credits

- Line 5: Qualified Dividends: Reports the partner’s share of qualified dividends received by the partnership.

- Line 6: Foreign Tax Credit: Reflects the partner’s share of foreign tax credits passed through from the partnership.

- Line 7: Other Credits: Includes other credits passed through to the partners.

Section III: Partner’s Distributive Share of Nondeductible, Pass-Through Expenditures

- Line 8: Nondeductible Expenses: Reports the partner’s share of nondeductible expenses incurred by the partnership.

- Line 9: Depletion of Oil and Gas Wells: Shows the partner’s share of depletion deductions related to oil and gas wells.

Section IV: Capital Account Activity

- Line 10: Beginning Capital Account: Reflects the partner’s capital account balance at the beginning of the tax year.

- Line 11: Capital Contributions: Shows any capital contributions made by the partner during the tax year.

- Line 12: Distributions: Includes any distributions received by the partner from the partnership.

- Line 13: Ending Capital Account: Reports the partner’s capital account balance at the end of the tax year.

Reporting Form K-1 Information on Your Tax Return

Partners or shareholders must include information from their Form K-1 on their individual tax returns. Here’s how:

Partnerships

- Schedule E (Form 1040): Partners report their share of partnership income and expenses on Schedule E.

- Form 8955: Partners must file Form 8955 to report their share of passive income and losses.

S Corporations

- Schedule E (Form 1040): Shareholders report their share of S corporation income and expenses on Schedule E.

- Form 8995: Shareholders must file Form 8995 to report their share of passive income and losses.

LLCs

- Schedule C (Form 1040): Members of an LLC taxed as a partnership report their share of LLC income and expenses on Schedule C.

- Form 8955: Members must file Form 8955 to report their share of passive income and losses.

Deadlines for Filing Form K-1 and Related Tax Returns for 2023

Form K-1 Deadline

The due date for partnerships and S corporations to furnish Schedule K-1 to their partners or shareholders is:

- March 15, 2023 for calendar year partnerships and S corporations.

Tax Return Deadlines

- April 18, 2023: Due date for filing individual tax returns for calendar year taxpayers.

- October 16, 2023: Extended due date for individual tax returns with an extension filed by April 18, 2023.

Seeking Professional Assistance

Taxpayers facing complexities related to Form K-1 or their tax returns should consult with a qualified tax professional, such as a certified public accountant (CPA) or enrolled agent (EA). These professionals can provide expert guidance, ensure accurate reporting, and help taxpayers avoid potential penalties.

Staying Informed: Latest Updates and Resources

- IRS Website: The Internal Revenue Service (IRS) website offers comprehensive information, instructions, and forms related to Form K-1 and pass-through entities.

- Tax Publications: The IRS publishes helpful tax publications, including Publication 569: Miscellaneous Deductions, which provides detailed guidance on reporting pass-through entity income and expenses.

Conclusion

Form K-1 plays a crucial role in reporting income, deductions, credits, and other tax-related information from pass-through entities to their partners or shareholders. Thoroughly understanding this document and accurately reporting the information on individual tax returns is essential for complying with tax laws and avoiding potential issues. Individuals seeking assistance should consult with a qualified tax professional for expert guidance and support.