Understanding Form I-9: Employment Eligibility Verification

Introduction

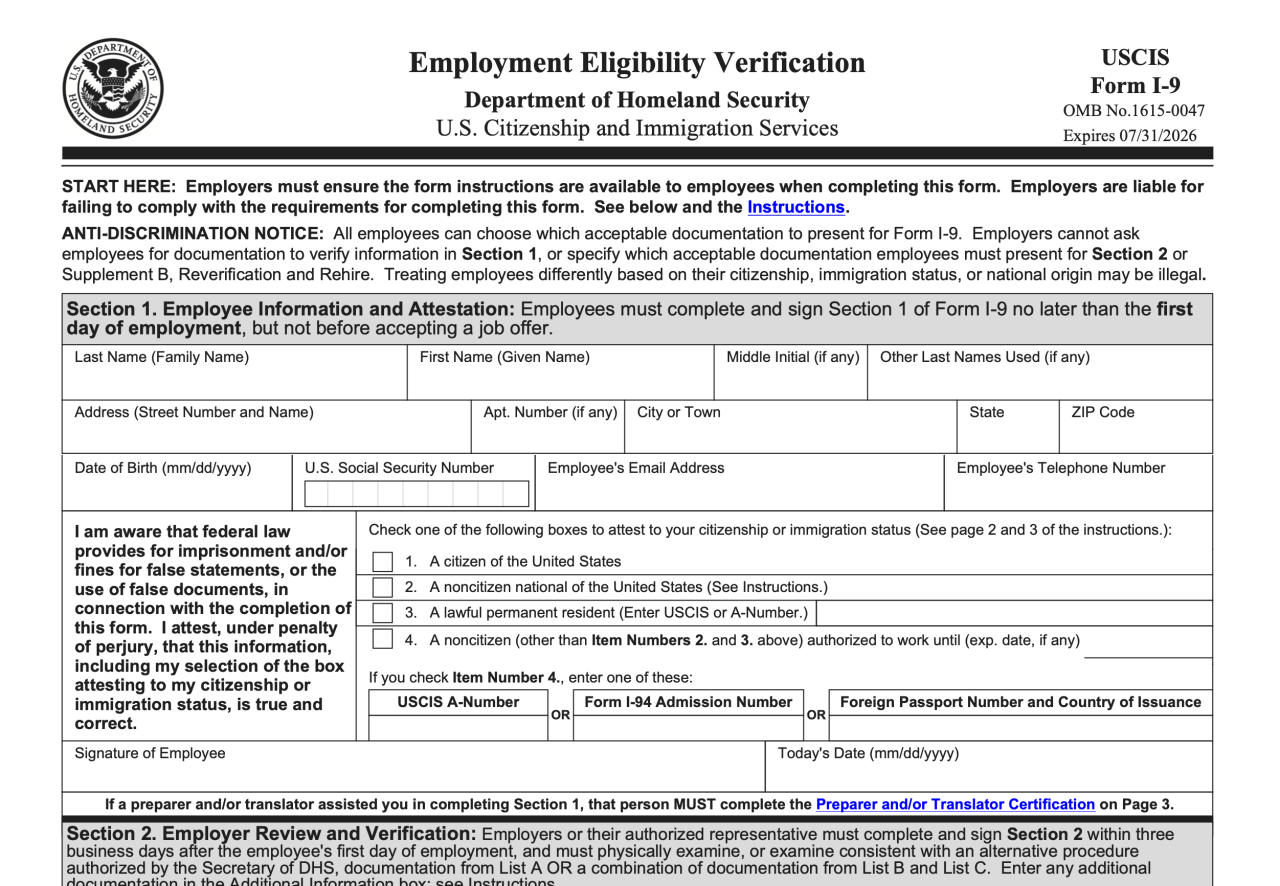

Form I-9, Employment Eligibility Verification, is a crucial document that employers in the United States utilize to confirm the employment eligibility of their newly hired workers. This comprehensive guide delves into the intricacies of Form I-9, encompassing its significance, completion guidelines, retention requirements, and the penalties associated with noncompliance.

Significance of Form I-9

Form I-9 serves multiple vital purposes:

-

Verification of Employment Eligibility: It enables employers to ascertain that their employees are authorized to work in the United States.

-

Prevention of Discrimination: By requiring employers to verify employment eligibility uniformly for all hires, Form I-9 helps prevent discrimination in employment based on national origin or citizenship status.

-

Compliance with Federal Law: Completing and retaining Form I-9 is a legal requirement for all employers in the United States, as mandated by the Immigration Reform and Control Act of 1986 (IRCA).

Completing Form I-9

The process of completing Form I-9 involves two distinct sections:

Section 1:

-

Employee’s Information: In this section, employees furnish personal details such as their name, address, date of birth, and Social Security number (if applicable).

-

Employment Authorization: Employees must provide documentation establishing their authorization to work in the United States. Acceptable documents fall into three categories:

-

List A: Documents that establish both identity and employment authorization, such as a U.S. passport or a Permanent Resident Card.

-

List B: Documents that establish identity, such as a driver’s license or a state-issued ID card, along with documents that establish employment authorization, such as a Social Security card or an Employment Authorization Document (EAD).

-

List C: Documents that establish both identity and employment authorization, but are only acceptable for non-U.S. citizens, such as a foreign passport with an appropriate visa or a Transportation Worker Identification Credential (TWIC).

-

Section 2:

-

Employer’s Responsibilities: Employers must examine the employee’s original documents, record the document information, and sign and date the form.

-

Employee’s Attestation: Employees must attest under penalty of perjury that they are authorized to work in the United States and that the documents they have presented are genuine and belong to them.

Retention Requirements

Employers are required to retain completed Form I-9s for a specific period:

-

Three Years After the Date of Hire: For employees who are still employed by the company.

-

One Year After the Date of Termination: For employees who have left the company.

Penalties for Noncompliance

Failure to comply with Form I-9 requirements can lead to substantial penalties:

-

Fines: Employers may be subject to fines ranging from $216 to $2,156 per unauthorized employee.

-

Back Taxes: Employers may be liable for back taxes, including Social Security and Medicare taxes, for unauthorized employees.

-

Criminal Charges: In severe cases, employers may face criminal prosecution, including imprisonment, for knowingly hiring unauthorized workers.

Conclusion

Form I-9 plays a pivotal role in ensuring a lawful and discrimination-free workforce in the United States. Employers must adhere to the guidelines and requirements outlined in this document to verify the employment eligibility of their employees and avoid potential legal consequences. Regular updates and guidance from the U.S. Citizenship and Immigration Services (USCIS) should be monitored to stay informed of any changes or modifications to Form I-9 regulations.